IRIS MyeInvois

Be e-Invoice Ready.

Be PEPPOL Ready.

Be Future Ready.

e-Invoicing in Malaysia

The Malaysian Tax Authority, The Inland Revenue Board of Malaysia (IRBM)/ Lembaga Hasil Dalam Negeri Malaysia (LHDN) and the Malaysian Digital Economy Corporation (MDEC) are gearing up to implement electronic invoicing regulations in Malaysia by August 2024. The rollout will be phased out based on turnover. e-Invoicing will replace traditional paper and electronic documents, encompassing invoices, credit/debit notes, and refunds. Some exemptions apply, including specific individuals and certain income/expense types.

IRIS has a long-standing

relationship with Malaysia

Suruhanjaya Syarikat Malaysia (SSM) Implementation

Implemented XBRL-based platform Malaysian Business Reporting System (MBRS) for companies to submit data to Suruhanjaya Syarikat Malaysia (SSM)

Suruhanjaya Sekuriti Malaysia (SCM) Implementation

Developed and implemented XBRL-enabled e-filing platform for funds to submit reports.

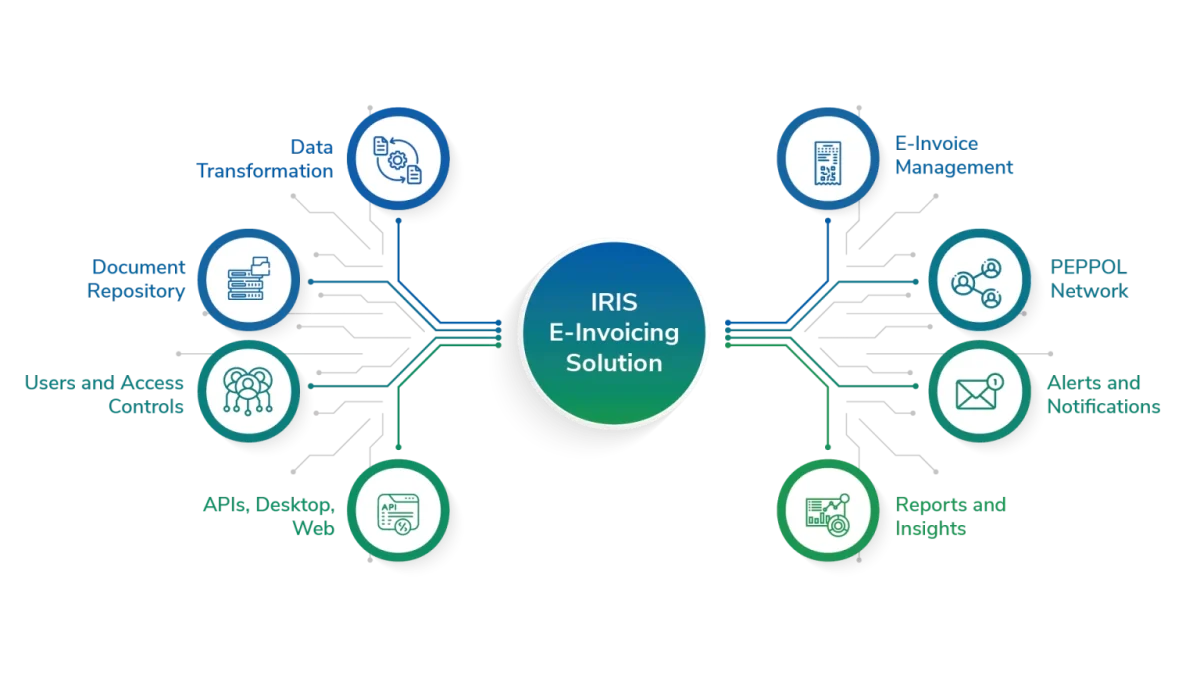

Our comprehensive solution for achieving

e-Invoice compliance

Navigate Compliance with MyeInvois:

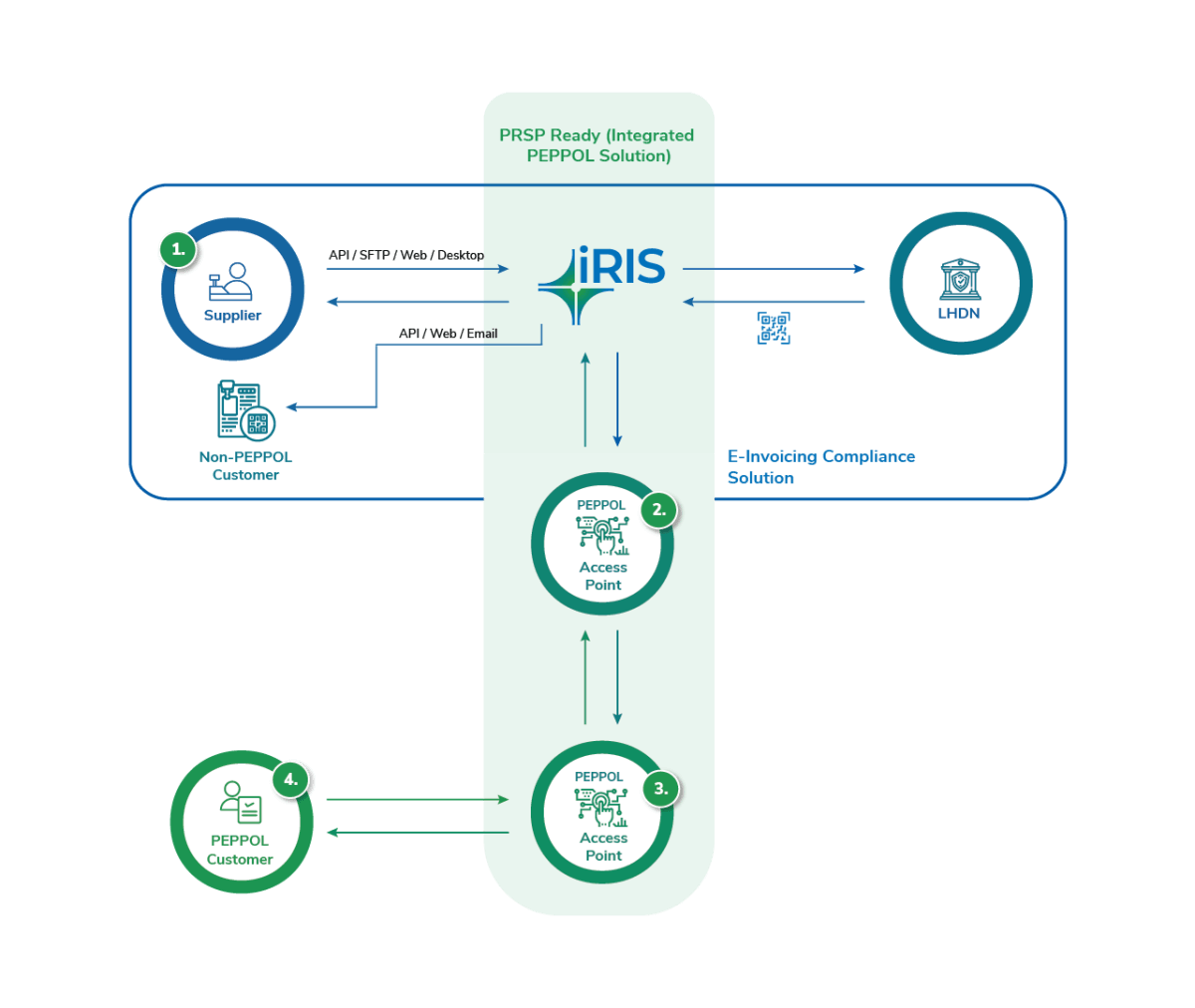

Your PEPPOL Integrated e-Invoicing Partner

A world-class e-Invoicing system that integrates with billing systems seamlessly in multiple ways with zero disruption to businesses. A PEPPOL-ready, one-stop platform to view, share and collaborate on invoices with customers and suppliers alike while managing the entire communication with the LHDN systems, in a hassle-free manner.

- Myeinvois comes with a pre-integrated Certified PEPPOL Access Point.

- Businesses need to do a one-time PEPPOL Setup on the IRIS Platform and enable the sharing of validated e-Invoices through the PEPPOL framework.

- Businesses can register with MDEC, Malaysia’s PEPPOL Authority via our integrated Access Point Provider.

- Businesses can also receive validated e-Invoices from their vendors who are on the PEPPOL network.

Why IRIS?

Authorised e-Invoice Portal

IRIS is authorized by the government of India for e-Invoice generation (IRIS IRP)

Most Agile

SaaS Product - SaaS Awards 2022

Best Tax Technology

Service Provider 2022 - TIOL Awards

FE Best Fintech

Award 2022 Winner

Authorised e-Invoice Portal

IRIS is authorized by the government of India for e-Invoice generation (IRIS IRP)

Most Agile

SaaS Product - SaaS Awards 2022

Best Tax Technology

Service Provider 2022 - TIOL Awards

FE Best Fintech

Award 2022 Winner

6 key areas to address while companies evaluate

and prepare for e-Invoicing

Impact analysis of Business scenarios and processes under e-Invoicing

Understanding the e-Invoice data fields and validations

Aligning billing process and billing print to incorporate e-Invoice number and QR code

Assessment of PEPPOL enablement for document sharing and receiving

Choosing the right e-Invoice Partner and not just software solution

Educate Stakeholders and Employees

What you can do with MyeInvois

1. Generate UIN

Generate a Unique Identification Number (UIN) and QR code for your sales as well as self-invoice transactions

2. Manage Complete e-Invoicing

Manage complete e-Invoicing for multiple organisations from single login

3. One-Time Configuration

Follow your data formats from source systems and with one-time configuration, get data ready for e-Invoicing

4. Seamlessly Register for PEPPOL

Seamlessly Register for PEPPOL through a PEPPOL Certified Access Pointand register for Flexibility to share e-Invoices in the 4-corner PEPPOL model and also non-PEPPOL customers

5. Validate and Verify E-invoice

Validate and Verify any Malaysian e-Invoice registered with LHDN

6. Stay Informed About User Activity

Stay informed about user activity and invoice status with extensive Audit trails and logs

7. Real-Time Insights

Get handy and real-time insights on your e-Invoices